VISION TO BE THE BEST PERFORMING HEDGE FUNDDelivering best in class risk adjusted returns

VISION TO BE THE BEST PERFORMING HEDGE FUNDDelivering best in class risk adjusted returns

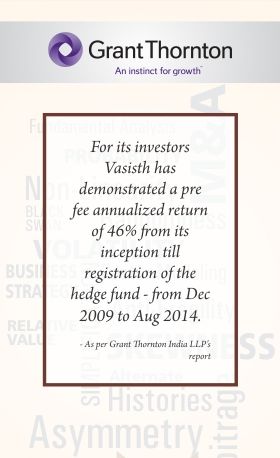

Across market conditions STANDOUT PERFORMANCE46% pre fee average annual performance for 5 years

STANDOUT PERFORMANCE46% pre fee average annual performance for 5 years

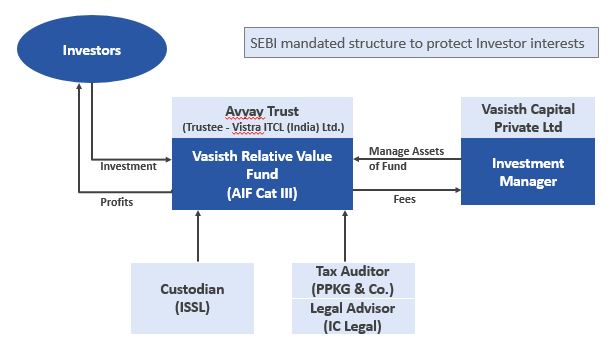

As certified by Grant Thornton FIRST RELATIVE VALUE STRATEGY AIF CAT III HEDGE FUND IN INDIATake advantage of market volatality

FIRST RELATIVE VALUE STRATEGY AIF CAT III HEDGE FUND IN INDIATake advantage of market volatality

Through fundamental insights of sectors and companies. Meticulous application of knowledge"Í never cared much about others' conclusions - only for the reasoning that led to

Meticulous application of knowledge"Í never cared much about others' conclusions - only for the reasoning that led to

these conclusions. That reasoning had to make sense to me. Through this process

I improved the chances of being right and I learned a lot from lot of great people."

- Ray Dalio